“In the race for retail relevance, your product isn’t just what you sell—it’s how fast and flawlessly you deliver it.” — WareLogix

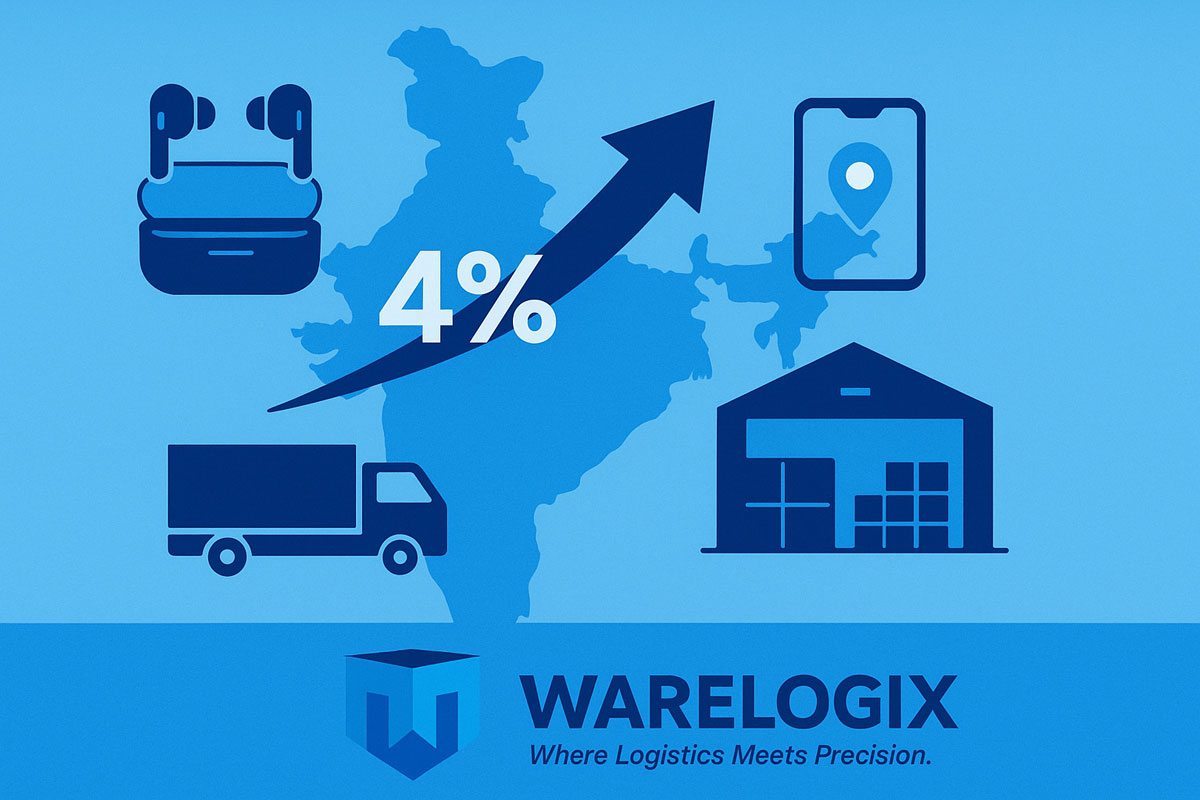

According to Counterpoint Research, India’s True Wireless Stereo (TWS) market saw a 4% YoY growth in Q1 2025, fueled by rising demand for personal audio devices. However, homegrown electronics brands are beginning to lose ground to aggressive global players like boAt, Samsung, and Xiaomi. The challenge now lies not just in product innovation, but in flawless delivery execution.

As international and D2C brands scale their presence in India, they’re facing a complex maze of import logistics, regional warehousing, and high-speed last-mile delivery. Add in frequent returns and high order volume during flash sales, and you need a logistics engine that doesn’t just move goods—but moves them smartly.

This is where WareLogix adds true value. Our tech-driven warehousing, pan-India multimodal transport, and real-time tracking are tailor-made for the high-velocity demands of the consumer electronics sector. From bulk port-side clearance to micro-fulfillment in Tier-2 and Tier-3 cities, we help brands scale without friction.

The Indian electronics boom isn’t slowing down. Whether you’re a global TWS player or a fast-scaling local brand, your logistics partner could be the edge you need. With WareLogix, logistics meets precision—so your brand meets its moment.

Read full news: ETBrandEquity